Embrace Innovation and Creativity, Safeguard Your Intellectual Property.

Henry Goh is a leading firm and pioneer in intellectual property protection in Malaysia and the region. The firm is consistently voted by peers as being among the top IP agencies in the country. Henry Goh provides IP services to a wide spectrum of clients from individuals and small businesses through to multinationals and Fortune 500 companies alike.

The Leading Firm of Patent, Trademark and Design Agents in Malaysia

From humble origins as a one-man business in 1977, Henry Goh has matured into one of the leading specialist IP agencies in the ASEAN region. With over four decades of experience in its field, Henry Goh is the top-tier pioneer in intellectual property in Malaysia. Today, Henry Goh employs more than 70 people, is headquartered in Kuala Lumpur and has a sister office in Singapore. Henry Goh currently operates in Malaysia, Singapore and Brunei Darussalam, and works closely with an extensive network of foreign associates worldwide.

Our People

Our Strengths

Years Established

Registered IP Agents

Professionals

Our Awards

IP Stars from Managing IP

• Tier 1 Malaysia Patent Prosecution 2004 – 2024

• Tier 1 Malaysia Trademark Prosecution 2009 – 2024

IAM Patent 1000

• Recommended Firm:

Malaysia Patent Prosecution 2014-2019

• Highly Recommended Firm:

Malaysia Patent Prosecution 2020-2023

• Gold Firm: Malaysia Patent Prosecution 2024

World Trademark Review – WTR 1000

• The only Gold Agency: Malaysia Trademark 2013-2025

IAM and WTR: The Global IP Awards

• Malaysia IP Agency of the Year 2019

• Malaysia Trademark Agency of the Year 2023

• Malaysia Patent Agency of the Year 2024

Managing IP Asia Pacific Awards

• Malaysia Firm of the Year – IP Prosecution 2024

Asia IP

• Tier 1 Malaysia Patent Prosecution

• Tier 1 Malaysia Trademark Prosecution

Global Leaders Awards

• Global leaders for trademark since 2023

• Global leaders for patent since 2024

Malaysia International Trade & Industry (MITI)

• MITI’s Certificate of Excellence for Export Services 2010

• MITI’s Excellence Award for Export Services 1999

Our Clients

We provide IP services to a wide spectrum of clients, ranging from individuals and small businesses to multinationals and Fortune 500 companies, from diverse industries such as pharmaceuticals, food and beverage, manufacturing, agriculture and many more.

Stream Group Sdn Bhd

“Knowledgeable and proactive in giving support and information.”

Mr Steven Koh

Chief Financial Officer (CFO)

Jasmine Food Corporation Sdn Bhd

“For many years, Henry Goh has assisted us in maintaining the intellectual property for our business. They are highly knowledgeable in these areas of expertise. Their prompt responses and thorough explanations help us to make the most appropriate decision for our requests. They will walk you through the process step-by-step and immediately inform you of its status. Their service has been excellent; they have been very helpful and responsive.”

Ms Nur Amalina

New Product Development Executive

Pos Malaysia Berhad

“Good and sound advice, accessible, friendly and sincere.”

Ms Shahreena bt Salihhudin

Senior Legal Counsel

Elken Group

“We have engaged them for a long period, and they consistently provide clear and concise legal advice. I highly recommend their services.”

Ms Anna Goh

Group Legal & Secretarial

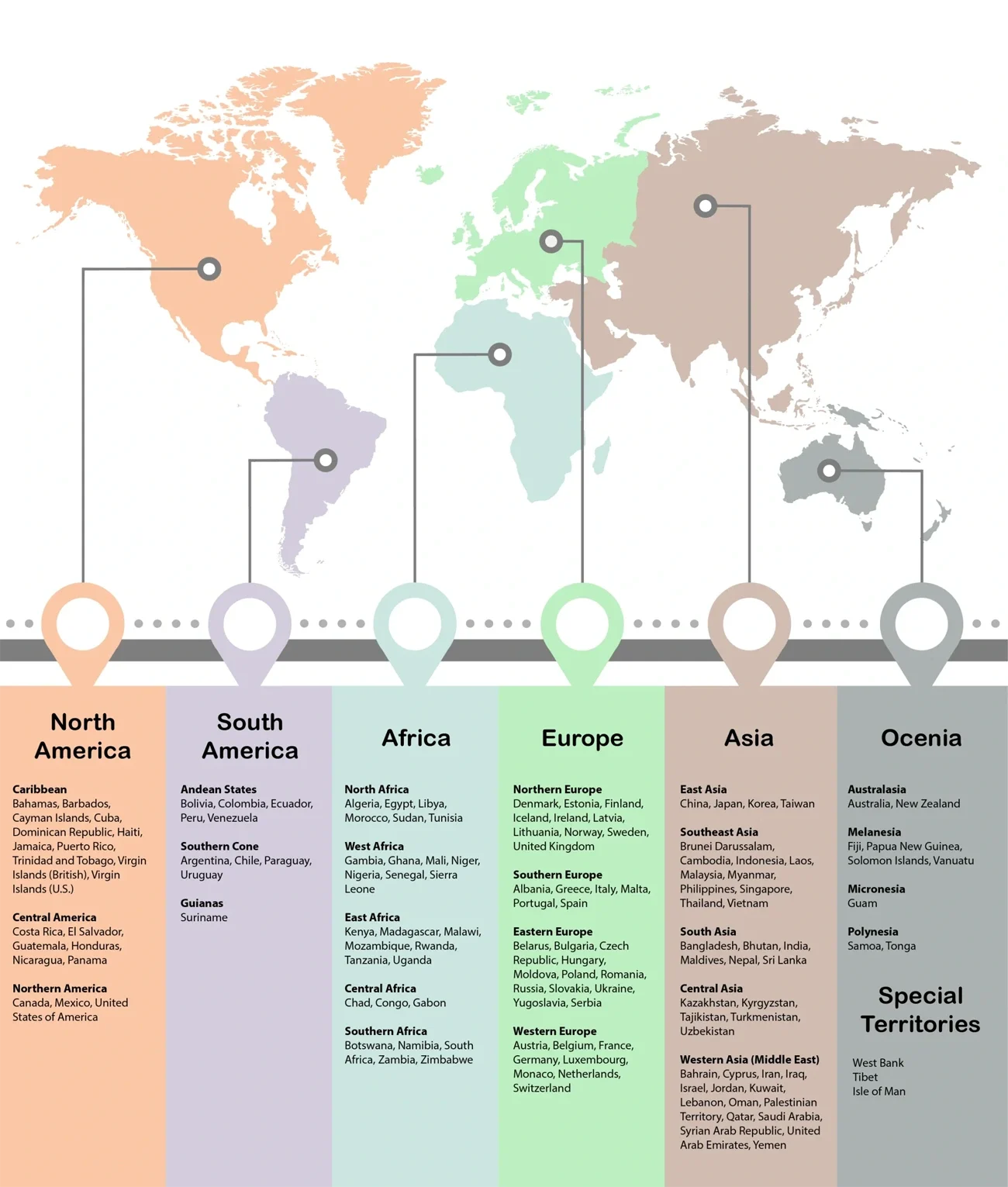

Worldwide IP Coverage

Major Jurisdictions We Serve

Global Reach of Henry Goh

We assist clients with intellectual property matters, providing expertise and support not only in Malaysia but also on a global scale, ensuring comprehensive coverage from local to international contexts.

Our Affiliate Partners

Frequently Asked Questions

Trademark

A trademark application can be filed based on current use or an intention to use the trademark in the course of trade in Malaysia.

Once a trademark becomes registered, there is no statutory requirement for evidence of use/filing a declaration of use in Malaysia. However, a registered mark becomes vulnerable to a revocation action if the mark has not been used in good faith within three years from the date of issuance of the notification of registration and there are no proper reasons for such non-use. A revocation action can be filed at court by an aggrieved party.

No. Only the official form and fees are required. Legalization and notarization are not required.

If an application has been filed in a Paris Convention country, it is possible to claim priority for an application to register the same trademark in Malaysia within a period of six months from the date of filing of the Convention application. A priority date will be relevant when the Registry conducts its examination for prior applications/registrations, but will not affect the date of filing.

A trademark registration is valid for 10 years from the date of filing and must be renewed every 10 years.

An opposition can be filed within two months from the date of publication of the application in the Intellectual Property Online Journal (IPOJ). This deadline can be extended up to a maximum of a further two months.

Any individual, business organization or legal entity can apply to register a trademark.

Trademark protection is territorial. A trademark registered in Malaysia is valid only here. If you intend to export your products or services to other countries, you should consider either registering your trademark directly in each and every country of interest; or use the Madrid Protocol system.

Patent

There are two options: normal substantive examination and modified substantive examination.

Normal examination is a regular, full examination process under which an application is checked for compliance with all formal and substantive patentability requirements. In determining patentability, reliance is made primarily on the results of prosecution of corresponding applications in certain recognized countries.

Modified examination is a simplified examination process under which a Malaysian patent will be granted with a specification (description, claims and drawings) essentially identical to that of a single corresponding patent of Australia, Japan, Korea, the United Kingdom, the United States or the European Patent Office.

The filing of a request for modified substantive examination may be deferred on the ground that the required supporting information or documents are not available.

Deferment must be applied for within the regular term for requesting examination. The maximum period of deferment is five years from the Malaysian filing date.

An application can be expedited by requesting expedited examination or requesting for processing under the available Patent Prosecution Highway (PPH) program such as the PPH programs (JPO, EPO, CNIPA, KIPO, USPTO) and the ASEAN Patent Examination Cooperation (ASPEC) program.

A voluntary divisional application may be filed any time from the filing of a patent application (known as the parent application) up to three months from the mailing date of the first examination report issued to that parent application. No extensions are available.

A divisional application takes the same effective filing date as the parent application. The divisional application will have a maximum term expiring at the same time as the parent application, that is 20 years from the effective filing date of the divisional application.